Today, I’m sharing parenting tips on investment money ideas. Money can be tight for many families. Raising children isn’t cheap. And, all parents want to create a brighter future for their family. Investing your money is one option to consider if you want to improve your financial future. Most importantly, investing your money will help give your kids the best possible start in life.

Many people think that investing money is for the rich. This couldn’t be further from the truth. Furthermore, there are many investments available for beginners. Those investments can be a great way to grow your money. And, you don’t need a million dollars to invest either. A little money each month will start a nice investment portfolio for your family.

Investment Money Ideas

Yes, investing can be risky, but there are ways to mitigate the risk while also giving yourself a chance at a significant financial upside. However, if you are going to invest in order to boost your family’s finances, you need to diversify your investment portfolio. Putting all your eggs in one basket is setting yourself up for disaster.

So, there are lots of different ways to invest, and it doesn’t have to involve investing large sums. Simply setting aside a little money each month and investing it should help you to eventually build an investment portfolio that’s continually growing. Of course, if you’re investing for the good of your family’s finances, you should stick to safe investment options.

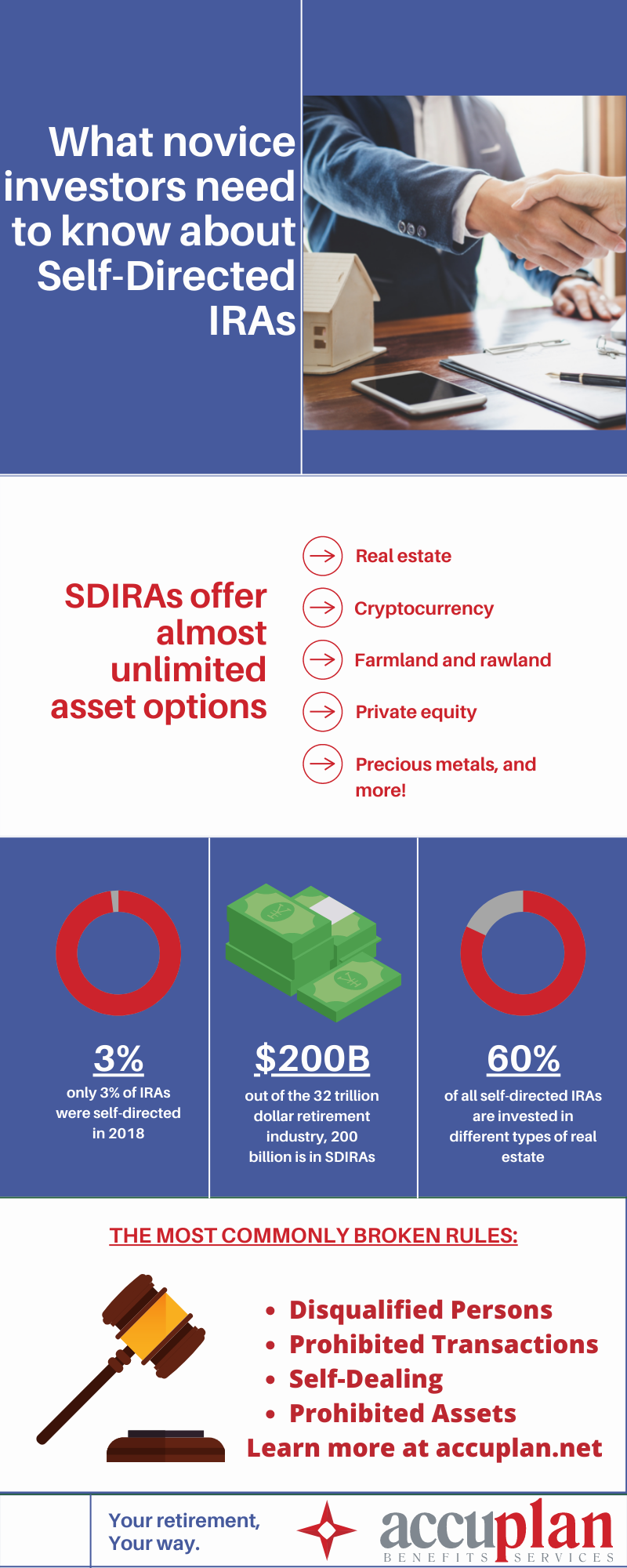

Investment Money Ideas for Self-Directed IRA

For example, if you’re focused on creating a diversified and varied way of investing, consider a self-directed IRA. These investment vehicles allow you to spread your investment across a range of alternative investment types. Find out more about them below:

Infographic designed by: https://www.accuplan.net/

Finally, do a little homework or better yet talk to a financial planner. They will be able to answer any questions you may have.